Empowering Canadians with the Knowledge to Manage Money Wisely

Welcome to Linquenta, your go-to resource for effective budgeting techniques and enhancing your understanding of personal finance. Join our community to explore practical personal budgeting tips and develop robust savings strategies. We emphasize the power of knowledge in cultivating money management skills for a financially secure future.

Unlock the secrets of managing your money effectively with our step-by-step guide tailored to Canadian lifestyles. Dive into budgeting basics and empower your financial future.

Start by listing all your monthly expenses. Knowing where your money goes is the first step in effective budgeting.

Document all your sources of income. Understanding your total income helps in planning your budget.

Define what you want to achieve financially, such as saving for an emergency fund or a vacation.

Linquenta is dedicated to enriching Canadian households by enhancing their money management skills. Our focus is on providing you with tailored resources that simplify budgeting practices and enhance financial literacy. Delve into our expertly crafted content designed especially for beginners looking to build a solid foundation in personal finance.

Discover the foundational principles of building a sustainable household budget. Explore practical budgeting worksheets and gain skills essential for managing your financial landscape.

“Understanding personal finance has never been easier! Linquenta introduced me to budgeting worksheets and effective budgeting techniques. Highly recommended!”

Emma Thompson

Teacher

“As a newcomer to financial literacy, Linquenta's resources on money management skills and savings strategies were invaluable. It made budgeting accessible.”

Liam O'Reilly

Graphic Designer

“Thanks to Linquenta, I mastered my household budget. Their personal budgeting tips are easy to follow and implement. I now feel more secure!”

Olivia Chen

Accountant

“Linquenta's insights into budget planning have transformed how I handle my expenses. It's empowering to have control over my finances.”

Noah Patel

Software Developer

“The focus on budgeting and understanding personal finance at Linquenta is perfect for beginners. I love the practical advice!”

Avery Sinclair

Financial Coach

“Effective budgeting techniques from Linquenta have changed my view on money management. It's about making informed choices and sticking to plans.”

Ethan Williams

Nurse

Linquenta is dedicated to providing Canadian individuals with the knowledge and skills necessary for effective budgeting and financial literacy. Our aim is to equip you with sustainable strategies for managing your personal finances, ensuring you can confidently achieve your financial aspirations.

Discover valuable insights and effective tips to enhance your budgeting skills and financial understanding.

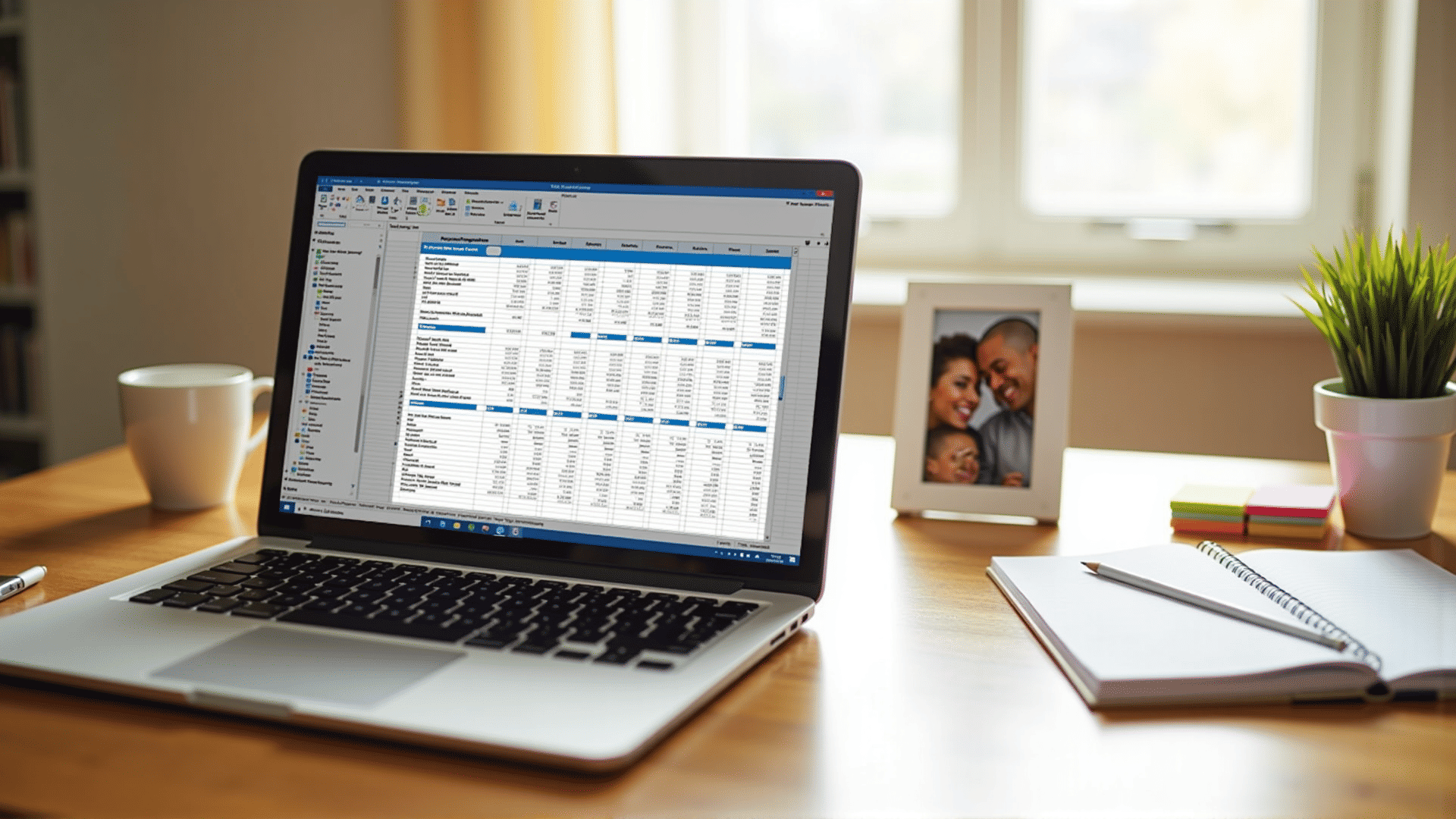

Personal budgeting is the process of creating a plan to manage your money. It helps you allocate income towards expenses, savings, and debt repayment. Understanding personal finance is crucial because it enables you to make informed decisions, prioritize spending, and achieve financial goals.

Beginners can start by seeking resources on financial literacy for beginners, such as online courses, workshops, and educational materials. Focus on understanding the basics like creating a household budget, developing money management skills, and exploring budgeting worksheets to build a strong foundation.

Effective budgeting techniques include tracking expenses, setting realistic financial goals, and regularly reviewing your budget. Utilize personal budgeting tips like the 50/30/20 rule to distribute income effectively and incorporate savings strategies to improve financial stability.

In Canada, you can explore various online platforms, libraries, and community organizations that offer educational materials on budget planning and financial literacy. Look for resources that provide tips on understanding personal finance and budgeting effectively.

We use cookies to enhance your experience. By continuing to visit this site, you agree to our use of cookies. For more details, please review our full policy. Read our Privacy Policy